Part II: History and Future of Contactless Payments

Read Part 1: The History and Future of Contactless Payments Here

WHAT MAKES CONTACTLESS UNTOUCHABLE?

Formerly known as “card machines,” terminals have provided the general public with a reliable payment system that is both undervalued and overlooked. History’s first card machine revolutionized the payment system shortly after AMEX developed the first plastic payment card in 1959. Although it was not of the electronic variation, the machine “enabled merchants to produce an imprint on carbon paper slips intended for the bank, merchant and customer as proof of purchase” (Sorenson, 2019) for the first time in human history.

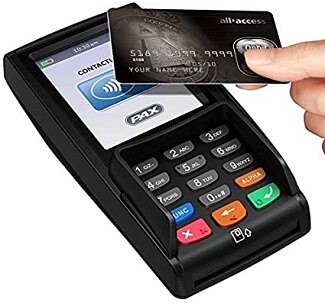

TRIED AND TRUE CREDIT CARD TERMINAL

The same year in which Americans celebrated their first Earth Day, the first electronic card machine was presented to the general public, in promoting the ideology of conservation. Thanks to tech giant IBM, the magnetic-striped payment card, otherwise known as credit cards, was revealed under IBM 360. (Sorenson, 2019) The use of the magnetic-stripe proved not only to be more efficient, but it was also more secure in comparison to its manual-entry predecessor, as the swipe strip was a brilliant form of encryption of personal data, as the strip contained the “name of the cardholder, card number, authorization code and expiry date of the card.” (Sorenson, 2019)

THE EVOLUTION TO EMV

In recent years, the world has been introduced to a new method of encrypted payment known as the EMV chip. Formerly known as “the smart card” (as dubbed by its inventor, Roland Moreno), the popularity of chip-use increased exponentially within the same decade, following its invention in 1975. As a matter of fact, chip-use became mandatory in France as of 1992. However, as with much of which pertaining to technological/societal advancements, the US fell behind, as EMV technology failed to fully integrate into the American payment sector until early 2015. Priority I.S.’ Vice President of Client Services Robert Copeland seems to welcome EMV technology with open arms.

“When looking at security of payments, it is important to look at how we got here. During my lifetime, mag-stripe had long been the conventional method of payment,” Copeland reminisces. “Most Americans will think that EMV is a relatively new concept, but the usage of chip cards really began in the mid-90’s.” Going into detail, Copeland explains that there are 2 types of EMV: chip and pin versus chip and signature, and, as with the encryption capabilities of the mag stripe, addresses general security concerns with the added protection of PIN or signature.

THE CONTACTLESS ERA

Two decades and two global pandemics later, the modern generation has come to adopt contactless technology as a necessity. While convenience defines the modern way of life, a newfound fear of deathly germs had become the centerpiece of 2020. Perhaps interpersonal trading was destined to integrate with an untouchable payment system known as contactless payments. Turns out, mobile payments are not always contactless, as any device capable of making payments using radio-frequency identification (RFID) technology is using contactless payment technology (NFC, 2017), wherein near field communication plays a vital role in making contactless – contactless. As cited from NearFieldCommunications.Org, “the first example of contactless payment came in the form of Speed-Pass in 1997. Mobil gas stations offered contactless payment devices that clipped onto a key ring. The customer waved the device over a labeled square at the gas pump and paid instantly.” (NFC, 2017)

Having experiences countless trials and tribulations within the payment industry, President/CEO of Priority I.S., Gary Liu, can attest to the rising of contactless payment.

“In my opinion, I do see contactless payments continue to grow in popularity here in the U.S.,” Liu attests. “Especially over the past 12-15 months during Covid, contactless payments have increased; especially in the early stages of the pandemic, during which many avoided surface contacts in fear of virus transmission.” Liu also expresses that contactless payment is not only the safer decision, but the sounder decision as well. “It’s become much easier to make a payment at Publix, etc., by simply pulling out your mobile phone.” With human-to-human contact going out of trend, Liu believes that QR codes hits a home run in the restaurant industry, as it is not only “contactless, but it is more convenient and a quicker method for consumers to make their payments without having to interact with their servers.”

Even Priority I.S. CS VP Robert Copeland, long-time EMV advocate, endorses the potential of contactless that is bound to win over even the least technology-savvy. “When you carry RFID credit cards, you need to make sure that you carry them in an RFID-protected device, and we never were told to do that with magnetic swipe or EMV. Security concerns only become more prominent with virus-laden emails and mobile links. Hackers can then steal the personal data on your device(s), which poses as more of a privacy concern in itself,” Copeland explains, “However, I will take my chances with that over having to worry the guy behind me stealing data from my physical card. The reliability of contactless is mostly dependent on how you use it.”

WANT TO LEARN HOW CONTACTLESS PAYMENTS CAN FIT INTO YOUR BUSINESS?

Contact Us Below and a Representative will Reach out to You Shortly.

![contactless payments_317416583 [Converted]-01.png](https://images.squarespace-cdn.com/content/v1/593014b0414fb58c4dfa2ca6/1624385871952-SF3QS4BUU6UXAVIL83GU/contactless+payments_317416583+%5BConverted%5D-01.png)

Recent Comments