Four Ways Small Businesses are Finding Additional Revenue Sources During an Economic Shutdown

The world has changed, and so has the restaurant and retail industry.

Through no fault of their own, companies are scrambling to find ways to keep their business afloat. Many restaurants have had to completely shift their business model relying on ingenuity to generate revenue when patrons are forced to stay and shelter.

BOLD is keeping a close eye on the events unfolding and the effects on our industry. This includes constant communication with our partners in hopes to share merchant success stories outlined below. While a few of these solutions may seem reactive given the current situation, it is important to consider the long term benefits these will have as consumer buying habits will shift when things get back to normal.

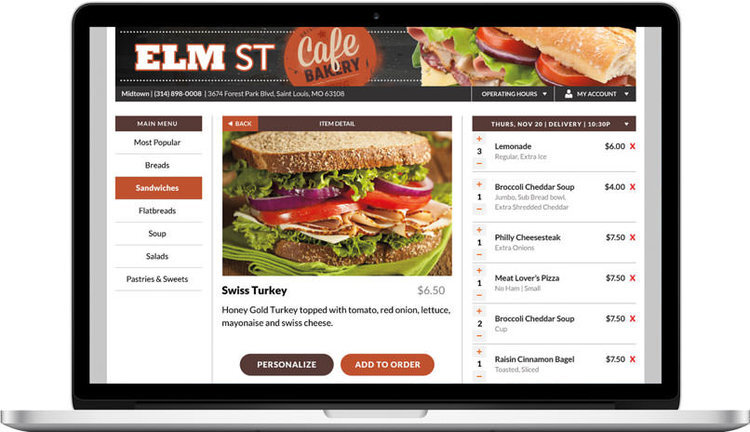

1- ONLINE ORDERING AND CONTACTLESS PICKUP

For restaurants, online ordering has been the lifeline for keeping their doors open during this pandemic. For those who had an online ordering “ecosystem” in place along with a healthy social media presence to promote their service, the transfer was a little easier. Others have had to scramble to fill the demand. Thankfully, many online ordering solution providers have stepped up to offer risk free periods for merchants. Some have even gone completely POS agnostic.

eTab– A stand alone online ordering solution that can be quickly activated and implemented into BOLD’s merchant accounts.

Retailcloud– From now until July 2020, merchants can activate their online store for free. After 90 days merchants have the choice to keep the site, upgrade for more products, and add additional features.

Restaurants are also promoting “Contactless Pickup”. Consumers are looking for as little human interaction as possible. When an online order is placed via phone or online, many businesses are capturing a description of the car used ot pick up the order. The food is then walked to the car and placed on the hood without the customer ever having to get out of the vehicle.

2- CASH DISCOUNTING

COVID-19 has forced many merchants to cut costs and monthly recurring fees. Depending on the merchant, “Cash Discounting” helps merchants eliminate monthly service fees and save hundreds to thousands of dollars a month in processing fees.

BOLD’s Cash Discounting Program eliminates merchant processing fees for businesses by passing the fees onto the customer as a “non-cash adjustment”. It is treated as a discount given to ALL customers who pay with cash, not as a surcharge added to a credit card transaction. Simply put, ALL goods and services are priced with the “Non-Cash Adjustment” and the discount is applied at the point-of-sale for cash purchases.

It is also important to note that due to the situation that we are in, merchants are running many non-qualified (manually keyed) transactions resulting in higher interchange fees. Merchants taking advantage of the Cash Discount Program benefit by avoiding these additional fees.

3- SIMPLIFIED AND FAMILY-STYLE MENUS

Restaurants are running skeleton crews. Many have limited their meal selections to family-style meals in order to streamline the kitchen and limit the food preparation and serving time. Other restaurants, like Tony Baloney’s mentioned below, are finding creative ways to stay afloat by selling kits of their menu items so families can pick up and prepare at home.

Examples of Some Restaurants Shifting to Family-Style Meals

1. A statewide limit on groups is never good for a catering company, so Quinn’s Catering in McDonough, GA found a way to stay active by offering curbside pickup for family meals.

2. Tony Baloney’s in New Jersey changed their online ordering selection to include DIY Pizza Kits that can be picked up.

4- PROTEINS AND ALCOHOL TO GO

The food shortages at grocery stores have given restaurants an opportunity for another short-term revenue source. With proteins hard to come by in the grocery aisles, restaurants are finding some success by offering curbside pickup on proteins and, depending on their city, alcohol.

Examples of How Selling by Bulk is Helping Restaurants

1. Recently, Texas Governor Greg Abbott directed the Texas Department of State Health Services to issue guidance allowing restaurants to sell bulk retail products from restaurant supply chain distributors directly to consumers.

3. In many cities, such as Las Vegas, local governments are adjusting regulations by temporarily allowing restaurants to serve alcohol along with curbside pickup in order to discourage congregation and allow a revenue source for restaurants.

No one could have expected the country to be in the position we are in. With the Federal Government extending social distancing guidelines until April 30, 2020, it is imperative for restaurants to find solutions to weather this storm.

If you have or need ideas on how you can help your merchants, please call the BOLD Response Team Hotline at (877) 515-1003.

Recent Comments