Let’s face it, many business owners see merchant processing as a commodity. And who can blame them? The industry pumps out salespeople who sell on rates alone and have limited knowledge of the industry, its regulations, and the systems that authorize their transactions.

Merchants tend to shy away from any discussion that involves credit card processing. Chances are, they have experienced an unfortunate event that left them telling themselves they will never switch again.

Objections to merchant processing has evolved over the years. Some are valid, and some are merely used as a polite way of expressing they are not interested. With that said, I think this a good time to share my “Top 10 Objection and Rebuttal” list with BOLD Partners. Hopefully this document will help you when you come across merchants who politely tells you they are “not interested.”

NICHOLE’S TOP 10 OBJECTIONS AND REBUTTALS

1. I’m Happy With My Current Provider

This is a common objection which usually means “I am not interested in talking right now,” even if they aren’t happy with their current provider. It helps to remind the business owner that is it important to review their statements every few months to expose any hidden fees that drive their cost up. You are not asking them to change. You merely want an opportunity to analyze their statements to confirm what they are paying is what they were originally quoted.

2. I Have A Contract That I Can’t Cancel

Trust me. They are not the first merchant that we have come across that is tied to a contract. What we have found is that many times there are more savings in breaking their current agreement for a lower merchant processing rate than waiting out the term. The right approach would be to request a thorough cost-benefit analysis and compare the monthly savings vs. the cost of breaking the agreement.

3. Last Time I Tried To Change I Had A Bad Experience – Never Again

The first step you will want to take is to find out if it was a financial issue or a setup issue.

If they ran into a financial issue, reassure them that we have rates explicitly designed for their industry and transaction needs. It would help to have a few sample statements ready to show so they can see the clarity of the reporting.

If it was a setup issue, they must be aware that many people in the industry can sell processing but are unfamiliar with the technology involved. BOLD specializes in point of sale and terminal setups. We work closely with each software company to make sure the system is set up and tested right the first time.

4. My Processor Gives Me The Terminal For Free – Do You?

A merchant’s agreement may state “free terminal,” but we all know nothing is free. Whether it’s a “annual/monthly statement fee” (which BOLD does not charge) or “technology fees” (which BOLD does not charge), many processors have mastered the art of hiding the cost of terminals in their billing.

5. I Already Have The Best Rate

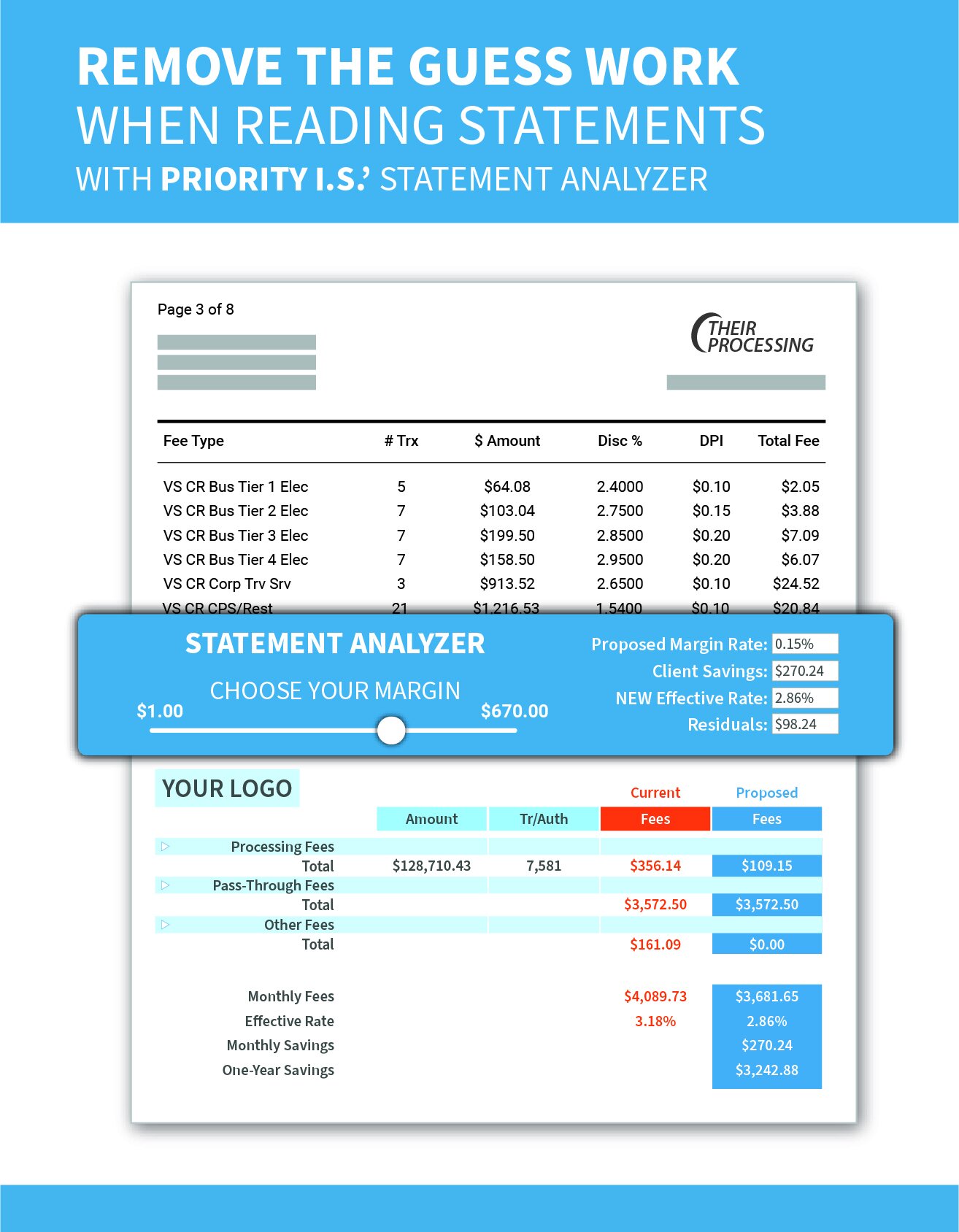

This is probably the biggest objection we hear. However, it would surprise you to know how many merchants switched to BOLD when a thorough statement analysis is complete. At no fault to the merchant, “I already have the best rate” usually means “I already have the best quote.” We need to help them understand that what was originally quoted is more than likely not what they are paying. The majority of statement analysis we perform reveal hidden fees that were never discussed during the quoting process. As a result, they incur a much higher effective rate than what they expect.

6. What Are Your Rates

While this response may sound “salesy,” there is no possible way to answer this question without understanding the merchant’s business and transaction types. You want to give the business owner the information they are looking for, but more importantly, you want to give them the correct information. Providing misinformed information benefits no one. Having a better understanding of the merchant’s monthly volume, transaction type (swiped, manually keyed, moto, etc.) and transaction amount/count is vital information to give an accurate quote. .

7. I Won’t Show My Statement

Many merchants are hesitant to share financials with strangers. It makes sense. Assure the merchant that the information on the statement is only being used to analyze their fees and will be strictly confidential. If it makes it easier, offer to review the financials with them present and that way you are not leaving with a physical copy. A few minutes can reveal a lot about their rates and can be very informative for the business owner.

8. No Thanks … I Just Changed Processors

If the merchant changed processors recently, now would be a better time than ever to complete a statement analysis! This will ensure they are receiving the Effective Rate they were quoted. Let it be known you are not asking them to switch. You would simply like to walk through their statement to explain the charges to make sure they fall in line with what was sold to them.

9. Every Processor Charges The Same, And There Is No Such Thing As True Savings

This is a common misconception in the merchant processing industry. The merchant needs to know that there are processors that run sales shops that are limited on the savings they can offer. However, there are Independent Sales Organizations (ISO) like BOLD who have greater control on the pricing they offer. Every rate and fee will be detailed in their agreement, and their statements are designed to outline their savings in a CLEAR and CONCISE layout.

10. This Is My Busiest Time Of The Year / Not A Good Time To Change

There is never a good time in business for a change but consider this. If there is a substantial monthly saving by switching and the changeover is seamless, isn’t the busy season a great time for a change to maximize their savings? The best approach that I have found for this situation is to assure the merchant you are not asking them to change right now. You are merely trying to analyze their savings. If they feel a switch-over is worth it, great! If not, then they have the information they need to perform the switch-over at a more convenient time.

I hope these suggestions help steer BOLD partners to educate business owners about merchant services. We all know people buy from people they trust. For me, a large part of my success in merchant services is built around me consulting merchants so they can make an informed decision.

Your BOLD Partner,

Nichole Kazenske

V.P. of Partner Relationships

nkazenske@boldpay.io

BONUS CONTENT

You didn’t think I have only ran across ten objections in my life time, did you? Below are additional questions/objections that did not make the top ten but are still worth mentioning.

Competitor

My Bank Does My Processing – My Accounts / Loan /Credit Cards Are With Them

Many banks are known for offering “perks” if business owners sign up for their processing. The truth is, the bank’s number one focus is having the business’s money rest in their banks. Changing processors has less impact than banks let on when it comes to interest rates and credit limits. Many times the merchants are paying MORE for the inflated processing than they would with a slightly higher interest rate.

My Processor And I Have Been Friends For Years – I’m Loyal To My Friends

Let’s all agree that loyalty is excellent, and it is prevalent for merchants to do business with friends at some point. However, while their friend may offer a “great” deal in processing, the agreement is based on the margin they can give. It is not uncommon for processors like BOLD. with lower buy rates than the competition to be able to save the merchant money.

I Use Quick Books To Do My Processing

Quickbooks is a handy tool when it comes to merchants running their business, and many who rely on the software also rely on integrated merchant processing. BOLD has solutions in place that enable the merchant to integrate with QuickBooks while saving money on processing.

I Use Paypal And Process On The Internet

The PayPal suite has gained traction in many brick and mortar stores. However, many merchants believe they are paying the best rates possible when they implement their solution, this is not the case. BOLD has won the business of many merchants who once used PayPal when a cost-benefit analysis was performed on their statements. Also the ROI of a POS system that is built for their industry.

Service

I Prefer To Deal With Someone Local

Who doesn’t like dealing with someone local? But what happens if that “someone local” decides to sell cars next month? Where does their support go? BOLD and their partners are available at all hours of the day ready to help. We are not a fly-by-night processor just passing through town. There is always someone available to help.

Hardware/POS

Do I Have To Buy / Lease A New Terminal If I Use Your Company

There are many value-added services offered by BOLD (i.e., MX Invoicing and MX Merchant) that allows the merchant to run credit cards with no additional cost or hardware.

Can I Use My Own Machine If I Sign Up With You

Machines can be reprogrammed. However, regulations change and many terminals can be deemed obsolete if they are not up to standard (i.e., EMV regulations). There are specific security issues mandated by the federal government that must be implemented when you get hooked up to our network. Many of the older model terminals do not have sufficient memory or features that allow this. Also, there are many new types of terminals being introduced today that provide you with features that make your life a lot easier, and it may be worth taking a look at what we can offer.

I Get All My Terminal Supplies For Free … Do You Offer Free Supplies

It is important to remember that no supplies are free (See Number 4 Above). Usually, this means that the merchant is being charged in some other way so that they are still getting paid for the supplies. It would be best to look at their statements to review the miscellaneous/hidden fees to determine where expenses can be cut.

My Processor Tells Me They Are The Only Ones Who Can Program My Machine

While this is true in some cases, it is essential to learn who their processor is. Like many of the options above, many times the savings in merchant service fees quickly make up for the cost of a $150 terminal.

I Have A POS System Installed To Do My Processing

Step one is to find out if they are happy with the POS system and the service. If they say “Yes,” inform the merchant that BOLD is built to be compatible with over 95% of POS systems and our team is designed to specialize in the POS industry. The second step is to offer compatibility consultation to review the software and the gateway/hardware used. If the merchant informs you, they are not happy with their POS system; this is a great time to determine the issues they are having and offer them a chance to review POS options that better fit their business.

Rate/Fee

Are There Any Monthly Fees I Would Have To Pay

Short answer…yes. But choosing an ISO that works with BOLD who can write direct deals with Visa/Mastercard, which means less “middle-men” and fewer fees.

All I Pay Now Is A Rate Of _____ % And A ____ Cent Swipe Fee … No Other Charges

This sounds like an amazing deal, and there is a chance this is true. More than likely, this also means they are quoting a cost-plus rate, which means a percentage/transaction fee on top of interchange rates. At this point, it becomes a game of who can offer the lowest cost-plus rate with service to back it up.

I Belong To A Processing Association – They Offer The Best Rates

While this could be true, the merchant needs to understand a reasonable rate does not mean they are receiving the best true effective rate. A true effective rate is a more accurate representation of fees when calculating rates. It involves dividing the total fees by total volume to determine the true rate charged against all tiers. Many times merchants are surprised to learn how much more they are paying when compared to what they were quoted.

General

I’m Too Busy To Deal With This Right Now

At this point, it might be best to practice patience with persistence. Offer to schedule a call or meeting at a better date and time. If it is an opportunity worth pursuing, find ways to keep them on your radar. Today might not be a good day for them. Chances are there will be a day they look for a change, and your name will be on the top of their list.

Would I Have To Sign A Contract /I’m not too fond of Contracts

Not many people like contracts. In this case, the merchant should be aware that the merchant processing agreement is designed to protect both parties. Plus, you are not asking them to sign a document to analyze their statement. You are merely researching their fees to inform them of any possible savings. Many times the savings is substantial enough that the agreement is a non-issue.

Read Part I of the Series Here

Read Part I of the Series Here

Recent Comments