Pass-through vs. Flat Rate Pricing: Presenting the Best Options to Your Merchants

“Why is my effective rate different this month versus last month?”

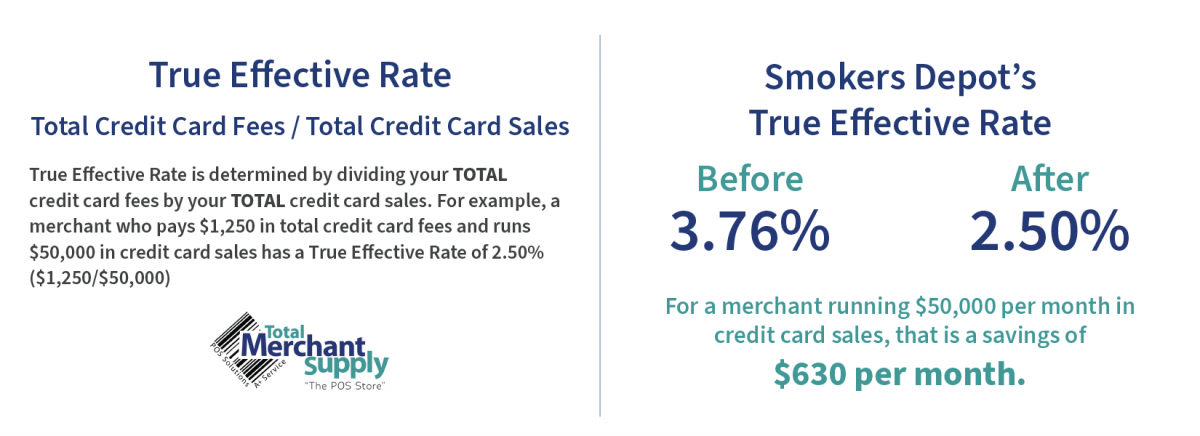

This is one of the most common concerns we hear from new merchants after their first few months of processing. Explaining the fundamentals of interchange to a merchant is no easy feat. When selling based on the effective rate, the pricing model used to pass the cost to the merchant is important. The two most common pricing models sold are pass-through pricing and flat rate pricing. How do these pricing models impact the effective rate, and how do you determine which pricing model works best for your merchant?

Pass-through vs. Flat Rate Pricing

Pass-through pricing

Pass-through pricing allows the true cost of processing to be passed on to the merchant. The benefit of pass-through pricing is transparency and lower costs. On a pass-through pricing model, merchant fees fluctuate monthly based on interchange and card brand fees. Interchange is determined based on card types, the merchant industry, transaction size, and other factors, such as reward cards that give you cash back and miles towards a consumer’s next vacation.

Common examples of factors that drive interchange costs are:

- Rewards Cards – Interchange costs are higher to offset the cost of the rewards programs to the cardholder.

- Keyed and e-commerce transactions – Without having the swiped and chipped data, the risk that the transaction could be fraudulent is greater and therefore, a higher risk. Address verification (AVS) helps mitigate the risk.

- Debit Cards – Have the lowest interchange costs due to the lower risk. Debit transactions are funded directly from the cardholder’s bank account.

- Average Ticket – Merchants with a lower average ticket qualify for interchange rates with reduced transaction fees, which lower costs.

- Industry Types – Schools, government entities, utilities, etc., have special interchange pricing that can lower costs.

Flat Rate Pricing

Flat rate pricing is not designed to be competitive; it is meant to be easy to understand. A flat rate pricing model gives merchants a fixed percentage that is not impacted by the cost of interchange or card brand fees. Regardless of the types of cards accepted or any of the other factors that influence interchange costs, the merchant’s effective rate never changes. It is essential to remember since the merchant’s rate is fixed, flat rate pricing should be priced high enough to cover the cost of fluctuations in interchange rates. Recommended flat rates are currently ranging from 2.75% – 2.99%. The varying costs of interchange will affect the overall residuals earned on a monthly basis.

| Pass-through Pricing | Flat Rate Pricing |

| Merchant cost is dependent on the interchange qualification. | Merchant cost is a fixed percentage. |

| Merchant effective rate fluctuates based on interchange qualification month over month. | Merchant effective rate remains the same regardless of interchange costs. |

| Partner earns a fixed residual percentage regardless of the underlying interchange. | Partner earnings fluctuate depending on interchange qualification. |

So, what is the right choice?

Choosing between flat rate pricing and pass-through pricing isn’t always an easy decision;

However, with so many variables it can be comforting for merchants to know their processing fees will not change. As long as the sales and average ticket don’t fluctuate significantly month to month, the cost will remain relatively constant and predictable.For these reasons, when it comes to selling merchant’s on the effective rate, we have found the best pricing model to use is flat rate pricing.

Looking to learn more about Pass-through vs. Flat Rate Pricing

Fill out the form below and a BOLD representative will reach out to you

Recent Comments